Your 10-Point Financial Guide to Moving Abroad

by Kareemah Ashiru in Culture & Lifestyle on 23rd December, 2021

To move or not to move? The idea of living in a foreign land where a new cultural experience awaits is a dream for many. But then doubts arise: “How can I afford it without a job?” “I only have 14 vacation days, I would have to stop working for a while” “What if it’s too expensive?” “What if I don’t make new friends?” “How could my medical needs be taken care of?” and for Muslims, another set of questions come to mind “What if the place isn’t Muslim-friendly?”

We’ve partnered with Algbra to bring you a 10-point-guide to moving abroad, written by avid traveller Kareemah! Algbra is building a digital bank driven by the pursuit of a balanced world through ethical financial services and community building. Sign-up to their waitlist where you can also make use of their lowest exchange rate for holidays and moving abroad!

The impacts of COVID-19 have made remote working the new norm for many, and has made many of us question if the grass may indeed be greener somewhere else. The flexibility of remote work opens the door to travelling more often, living somewhere new, and even spending more quality time with loved ones around the world. However, it takes courage to leave your comfort zone and move abroad.

There are hundreds of Muslim women setting up homes in new countries every year. In September of 2015, I decided to answer those questions for myself. After graduating with a degree in Finance, I moved to Madrid, Spain to explore my interests (language and culture) before I subjected myself to a cubicle for the rest of my adult life. It turns out that I (almost) never returned to that cubicle. What was supposed to be a one-year trip abroad turned into two. Research, trust in Allah, and good financial planning allowed me to extend my stay. While this was my experience, there are hundreds of other Muslim women setting up home in new countries every year. Here are the stories of two others: Naima who moved from Germany to South Korea and Sumia who moved from the UK to the Netherlands. Welcome to your ultimate guide to moving abroad!

1. Picking a Country and Cost of Living

When picking a country, two key determiners will be affordability and income opportunities. The first port of call is to understand where it makes sense financially to move based on what you can afford at the moment.

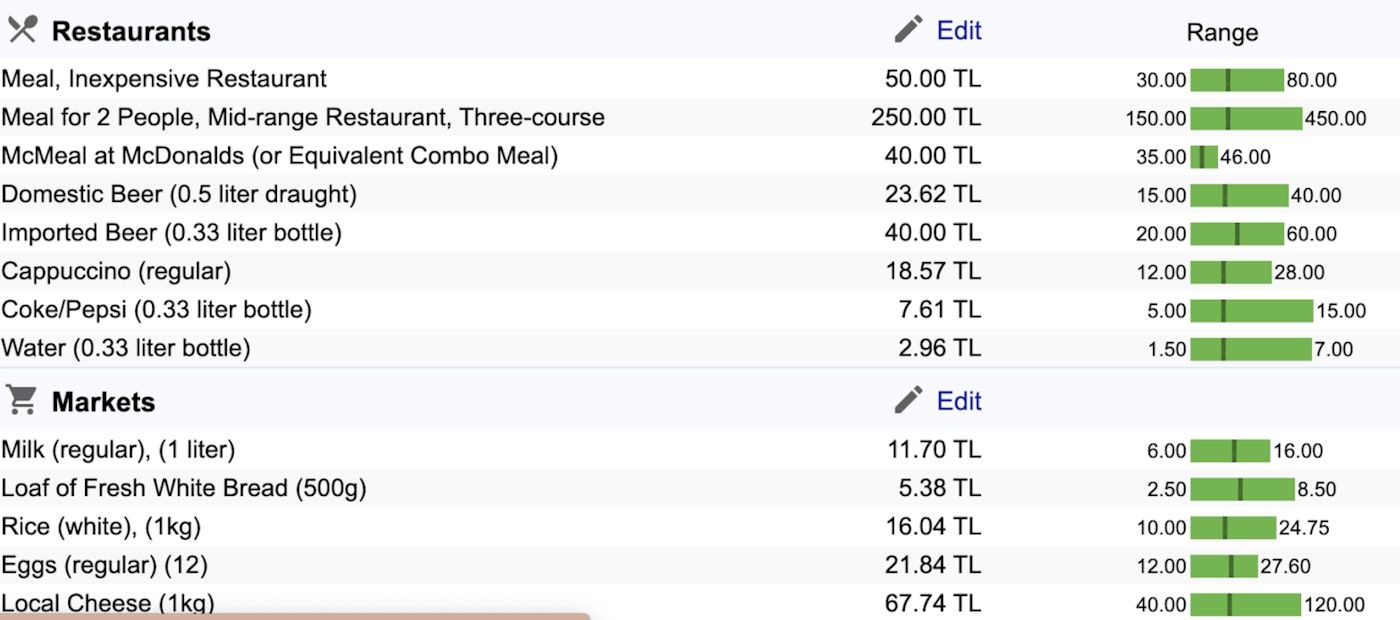

The cost of living in relation to your income or means will help to determine the quality of your stay in a foreign country. Numbeo is a great tool to calculate the cost of living for any destination of your choice. Research the comparable cost of living between your home country and the country of destination. This will give a good idea of how much you need to live comfortably.

For example to move from London to Istanbul:

- Family of four estimated monthly costs are 1,072.71£ (17,231.54TL) without rent (using our estimator).

- A single person estimated monthly costs are 303.23£ (4,870.96TL) without rent.

- Istanbul is 59.56% less expensive than London (without rent, see our cost of living index).

- Rent in Istanbul is, on average, 84.52% lower than in London.

Numbeo will also give you what the average cost is to eat out and do a grocery shop!

- Sumia’s monthly expenses in the Netherlands, excluding rent, were about £519.

- Naima’s expenses were approximately 700€ in South Korea

- Kareemah’’s were around 300€ in Spain where she enjoyed the 10€ 3-course meal also known as menu del dia that Spain had to offer.

Algbra also has an in-built Spending Analytics & Budgeting feature as well as Transaction Categorisation which automatically tracks your spending by category and type so that you know exactly what you’re spending on, allowing you to limit or encourage your spending in areas that better suit your lifestyle in your new country.

When moving to a new country it’s important to know the average cost of essentials like accommodation, utilities, groceries, healthcare, etc. Once you know what that is, my financial rule of thumb is to have at least 6 months to 1 year of savings to assist you in times of difficulty, unemployment, unforeseen events and so on. Of course, this is not a set-in-stone rule, It took me approximately 3 months to feel settled in my new home.

2. Source of Income

This is one of the most important parts of moving abroad. If you are easily able to relocate remotely for work then it is a simple exercise of comparing your current cost of living in your home country to your new one and seeing if it stacks up. If not, some of your options are:

- Ask your current employer for a potential job transfer or the option of going remote which more companies are open to in a post-COVID world. If it is not a long-term option for them, see if it could be something you can do for 2-3 months to still experience it (visa dependent). This is ideal if you work in an international company.

- If that’s not an option, online sites like LinkedIn, Indeed, It’s a Travel O.D (for remote jobs) and Glassdoor are great tools to start off with when job searching.

- Find out what the local job boards are by asking Facebook Expat groups or get a job through school programs or country-specific schemes like Erasmus.

- Getting a teaching job is one of the fastest ways for Native English speakers to get a job in many countries.

Sumia was able to make a gradual transition from the UK to the Netherlands by working remotely as a Freelancer so she didn’t have to worry about looking for a job. I found employment using Lingo Bongo, a Spanish local job board for Language teachers. Others gain employment through their school programs, like Naima who worked as a research assistant through an Erasmus Mundus Program in South Korea.

Sumia’s financial tips

- Figure out what financial support systems are available to where you are moving to.

- Have more than one debit/credit card and get a local bank as soon as possible to avoid losing money in exchange rates if your main income is in another currency.

- Living can be expensive no matter where you live, so figure out your basic necessities, take a chance and make memories (by yourself or with whoever comes along the way)

3. Getting to your new country

Here you need to think about flights and visas. Some countries have stricter rules than others, while other you can go on a tourist visa till you find work (which may not be guaranteed). You may want to do a ‘pilot trip’ for a short period to get your bearings, which is especially useful if you can work remotely abroad.

There are a growing number of countries offering digital nomad visa options like Bali, Barbados, Bermuda and dozens more! While these visas can be more expensive to apply for, these visas are longer than tourist visas, there are different requirements based on the country like a proof of funds needed or not being able to be employed by a local company. You will also need to research the specific tax implications!

For Visa entry, check out official government websites like the U.S. Department of State, Gov.Uk, European Commision, and many more for entry requirements to your destination of choice.

Know how long your passport should be valid for before entry and before departure. Visa requirements could vary depending on the duration, your nationality etc. Naima had to show a tuberculosis test, which cost about 60€. Your workplace can assist you with the visa process as well. I worked as a teacher with BEDA and the Auxiliares program. These organizations grant their teachers 1-year visas with an annual renewal option once the school contract ends. Naima had her workplace facilitate the visa requirements. In general, save at least $200 to finalize this process.

For flight costs, keep in mind that ticket prices aren’t the same in every airport location. For example, a roundtrip flight to Madrid from JFK in New York could cost approximately $600 whereas from MSY in New Orleans could cost $1200. You can book a one-way plane ticket if you aren’t yet sure about your return date. This could sometimes be a cheaper option. Naima paid 470€ for a one-way flight from Germany to South Korea. If you are flexible on your return date, consider an open ticket that allows you to return when you please without worrying about the cost. Learn more about open plane tickets here.

Naima’s Financial Tips

- Write down your budget and track your expenses, even the smallest purchase and reexamine at the end of the month.

- It is okay to spend money, but don’t become reckless.

- Always have some money saved.

4. Accommodation and where to live

Accommodation is likely to be one of your biggest costs. You can easily find out what the average rental prices go for online. Depending on your budget and lifestyle, you can decide if you want to live alone or in a shared space.

- Use Google maps to scope out areas and keep in mind if you will need to spend extra money to get around from where you live.

- If public transport is limited, it may be better to pay a bit extra to live somewhere convenient so you save on taxi or car fares!

In South Korea, the standard rate for a double dorm room with a bathroom, and a communal kitchen would be about 1800€ for six months. Students have to pay this fee upfront. Naima was lucky to pay less than that for rent due to the subsidies offered by her department. I paid around 400€ for a room in a two-bedroom apartment when I lived in Madrid. In the Netherlands, Sumia paid between £650 – £850 for a studio close to central. In terms of paying the bills, it may take some time to set-up a bank account in your new destination so using a tool like Algbra with Low-Cost FX Spend will allow you to spend your money while abroad at the lowest exchange rates.

Kareemah’s financial tips

-

Bring a credit card or backup card in case one gets missing. My debit card (the only form of payment I had then), was swallowed by the ATM machine. I had to survive on cash income for 1.5 months before I finally got a new card shipped to me from the U.S.

-

Carry cash! I would advise future me to have at least 1 month’s living cost in cash in case of an emergency.

5. Transportation

The systems used in a city to get from point A to point B is worth knowing. In some cities, public transportation is faster and affordable. In others, private vehicles might be a better option. Public transport in South Korea is very advanced and cheap, especially compared to Germany. One subway ride would start at 1€ (1250 Won) and would increase depending on the zone you’re travelling to. Naima spent about 35€ per month on average during her stay in South Korea. In the Netherlands, the cost of transportation ranges between £6 – £8 per week for an intercity work commute via tram/metro. One can also pay between £130 – 200 for a second-hand bicycle. If you are under 26 in Madrid, you will be eligible for the Abono Joven, a monthly metro pass of 20 euros for all the city zones. Transportation tickets range between 54.60€ – 63.70€ for 26 years and older.

6. Healthcare

Choose the most suitable healthcare for you especially if you plan on staying long term. Some countries have affordable and accessible healthcare for all including non-citizens. As a non-Spanish resident, I was given access to healthcare and only paid 20€ per month for health insurance, an amount that will never happen in my lifetime in the U.S where the average health insurance fee starts from $400+/month. It is mandatory in South Korea to pay national health insurance when staying longer than six months in the country, which costs about 30€ per month. In other scenarios, your school or company can help cover health insurance costs while abroad. This was the case for Naima, her health insurance cost was covered from her school tuition. On the other hand, Sumia had to pay approximately £110 per month in Health Insurance costs.

7. Tax

Be aware of your tax obligation. As an American living abroad, I still must pay U.S. taxes. Non-Spanish residents are taxed between 19% – 45% depending on one’s yearly income (source). Programs like the Foreign Earned Inclusion, Foreign Tax Credit, Foreign Housing Exclusion protect Americans abroad from double taxation. However, my situation was different. I taught English in a public school and our “salary” was labelled a scholarship from the Spanish government. Because of that label, I wasn’t required to tax my income. This was also the case for Naima due to her status as a student in South Korea. Sumia paid £320-£350 annual council tax, an unexpected expense that she had to manage. “What shocked me was the level of taxes I had to pay and how quickly the local council hands out fines – I’ve learnt this the hard way”, she says.

8. COVID info

Learn what Covid restrictions are put in place for your country of destination. Expect to show proof of vaccination. I would recommend saving $200 for Covid related expenses. Refer to the CDC for worldwide Covid requirements.

9. Safety

“When signing a rental contract or being concerned for my safety, I always lie and mention that I have family close by. You never really know who’s paying attention when you live by yourself and still learning your surroundings. Being stubborn or cautious can be both a positive and negative thing. Know when to ask for advice/help but also trust your gut and ask more questions” Sumia advises. U.S. nationals can use the STEP program to receive important information from the embassy about safety conditions in your destination country and to help your loved ones keep in touch with you in case of an emergency. Online safety is also very important to consider when making the move abroad. With Algbra, you can rest easy knowing that handy features like Disposable Cards will allow you to spend online securely using cards that expire after each usage to protect your account.

10. Connect with the local community

Whether it’s Dutch, Korean, or Spanish, learn the official language to connect better with locals. “The biggest issue was food, since I did not speak Korean, and I did not own a Korean bank account. It was very difficult to order food. I packed a bit of food but not enough for two weeks. Luckily, my mom’s cousin’s friend (much love to her!) was living in Korea, and ordered food for me” said Naima. Sumia on the other hand didn’t face similar language barriers as Naima:

“Perhaps the easier aspect of the move is that most services offer English speaking support, so although my bills are in Dutch, I can call my housing agency or the council and speak to someone in English”.

I personally love learning languages so I did a lot of language exchanges known as intercambios in Spain to improve my Spanish, making friends along the way. You can also go to mosques to make new Muslim friends or join Facebook groups like Muslimahs Who Travel.

The easiest part of moving

- Kareemah: Getting a teaching job. Teaching English is one of the fastest ways for Native English speakers to get a job in Spain due to its demand.

- Sumia: Most services were offered in English

- Naima: Visiting new places with some Covid restrictions lifted.

The most difficult part of moving

- Kareemah: Missing the diverse food options that the U.S. offers when living in a generally homogenous country like Spain.

- Sumia: The irregularity of Freelance work which caused financial strain. Also not being present for the special moments of loved ones.

- Naima: Being far away from family and friends for a long time.

To wrap this guide up, I will leave you with a few words of encouragement from Sumia and Naima for those hesitant to move abroad:

“Everyone talks about the importance of saving but I think it’s equally as important to focus on making it happen no matter what life throws at us. Create a timeline and adjust if needed but trust that the worst can happen and you’ll figure it out. Trusting yourself is a big part of this. Sometimes you have to be flexible with relinquishing control and stepping into the unknown. My faith and reliance on Allah and Rizq is a big part of this.” – Sumia

“I would first ask for the reasons for being hesitant. If it is just about going to another country, then I would advise you to just try it for a set period of time, and if it is horrible, just go back or go somewhere else. Nothing is set in stone.” – Naima

There you have it! I hope the information from this comprehensive guide inspires you to take a leap of faith and explore beyond your world. When you do so, share your journey to the world because you just don’t know who you might inspire.

*Sign-up to the Algbra early bird waiting list so you can be the first to join the app. You’ll also be the first to hear about their latest services, learn more about how to manage your money and grow your wealth in the process.

Kareemah Ashiru

Kareemah is a writer and content creator. She founded Hijabiglobetrotter, an online platform that highlights travel and lifestyle from a Muslim's perspective. She is also the co-founder of Muslimahs Who Travel, a Facebook group that unites female Muslim travellers around the world. Kareemah is based in New York City, when she isn't planning a next travel adventure, you can find Kareemah hosting a dinner get together, playing tennis, reading a book, or watching a travel show. Connect with Kareemah on: YouTube: https://www.youtube.com/c/Hijabiglobetrotter Instagram: https://www.instagram.com/hijabiglobetrotter/ Website: https://www.hijabiglobetrotter.com/